Research & Development Allowances: Don’t Overlook the Opportunity

Head of Capital Allowances, Callum Byers CTA ACA, explains how RDAs can provide significant tax savings in several ways.

It’s often overlooked that in addition to the R&D tax relief scheme for revenue expenditure, further tax relief is also available on capital R&D expenditure. Research & Development Allowances (RDAs) offer a 100% first year allowance on capitalised costs of carrying out R&D or providing facilities and equipment used to carry out R&D.

Benefit

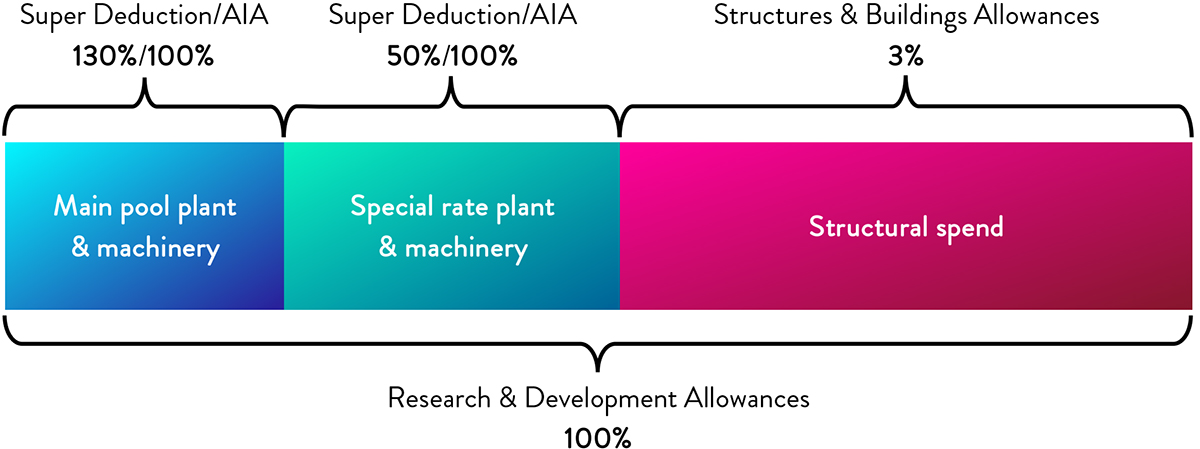

RDAs offer a 100% first year deduction for expenditure qualifying in the first year, and a key feature of the relief is that the allowances are not limited to plant & machinery expenditure (as is the case for Super Deductions and the Annual Investment Allowance).

The diagram below illustrates how expenditure on a building used for R&D might be split in a typical capital allowances analysis vs an RDA capital allowances claim.

Furthermore, given the flexibility of capital allowances, the 130% Super Deduction could be claimed on the main pool expenditure alone, with RDAs being claimed on the remainder of the building, to fully optimise the tax relief available.

If we assume that 50% of a £1m newly built laboratory relates to structural spend, then RDAs may offer a further £95k of tax savings in the first year, over and above the allowances identified by a traditional review.

Who can claim?

RDAs can be claimed by companies, partnerships and individuals who have incurred capital expenditure in relation to their R&D activities. The definition of R&D for RDAs is the same as for R&D tax relief, so you may already qualify for RDAs if you are making an R&D tax relief claim.

If you aren’t claiming any R&D tax incentives, but suspect you have qualifying activities, our team can assess your eligibility.

Examples of qualifying capital RDA expenditure include:

- Laboratories, offices, and other workspaces (including building structure) where R&D is carried out

- Toilets, staff rooms and other ancillary areas used by employees carrying out R&D

- Machinery and equipment, computers or software used to carry out R&D

Additional Considerations & Opportunities

Partial use and change of use

It's common that employees will divide their time between R&D and non-R&D work. The areas where these employees work may qualify entirely for RDAs, even though some of their time is spent on non-R&D activities.

Furthermore, if the building, area or equipment purchased for the purposes of carrying out R&D is subsequently repurposed for a non-R&D activity, no claw back of allowances is required.

Loss making companies

The March 2021 budget introduced provisions that allow companies to carry back losses across three years instead of one, for periods ending between 1 April 2020 and 31 March 2022. This allows loss making companies to benefit from a claim for RDAs by offsetting the deductions against profits arising up to three years prior - potentially unlocking significant tax repayments.

Time limits

RDAs must be claimed in the tax computation for the year that the expenditure is incurred. This means you have two years from the end of the accounting period where the assets are acquired to make a claim.

Get in touch

If you think you may be in position to benefit from Research and Development Allowances, and would like a free consultation, we’d be delighted to hear from you at hello@yes.tax.

YesTax.Positively better.